This is an update to my previous blogs:

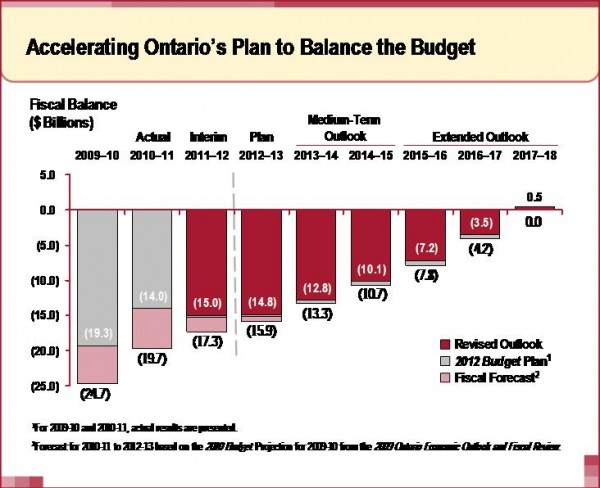

The recently updated 2012 Budget outlined the government’s plan to eliminate the deficit, and balance the budget by 2017-18 as follows:

- Additional revenue from:

- A temporary new Deficit-Fighting High-Income Tax Bracket for individuals earning more than $500,000 annually:

- income tax rate on taxable incomes over $500,000 will increase by two percentage points (i.e. two per cent point surtax), from 11.16 per cent to 13.16 per cent

- this change would generate additional revenue of:

- $280 million in 2012-13

- $470 million in 2013-14

- and $495 million in 2014-15.

- All of the additional revenue raised by this proposed measure would be used to reduce the Provincial deficit and accelerate Ontario’s plan to eliminate the deficit by 2017-18.

- The new tax bracket would be eliminated once the budget is balanced by 2017-18.

- A temporary new Deficit-Fighting High-Income Tax Bracket for individuals earning more than $500,000 annually:

- and by not increasing overall spending

- the Province’s deficits are now projected to be lower than the 2012 Budget each year between 2011-12 and 2016-17.

McGuinty Government aims to accelerate Ontario’s fiscal plan to balance the 2012 Budget in order to eliminate the deficit even faster by 2017-18 via the proposed measures above as well as redirect proposed new savings (from other measures) to support important social priorities with no net new provincial spending, which include:

- Strengthening child care sector to help families experience a seamless transition to full-day kindergarten, which will require the government to invest an additional:

- $90 million in 2012-13

- $68 million in 2013-14

- and $84 million in 2014-15.

- This investment will be funded from within the Ministry of Education’s allocation published in the 2012 Budget.

- Increasing social assistance rates in the fall of 2012:

- One per cent increase in Ontario Disability Support Program (ODSP) rates

- The annual cost of this policy is $33 million — and will come from additional savings measures worth $75 million

- One per cent increase in Ontario Works (OW) rates

- The annual cost of this policy is $22 million — and will come from additional savings measures worth $75 million

- This initiative will provide about $55 million annually in additional benefits to families and individuals receiving social assistance.

- One per cent increase in Ontario Disability Support Program (ODSP) rates

- The government will make a one-time investment of $20 million in 2012-13 to help 55 small, rural and northern hospitals improve patient care and transform their organizations.

- These funds will be allocated through Local Health Integration Networks on a proportional basis for transformation in small, rural and northern hospitals.

- The funding will allow changes to better serve their patients and improve the collaboration between small and rural hospital care and community care.

- The expense changes generate net savings of $35 million in 2012-13, which will be applied against this provision.

The government is also now projecting a $0.5 billion surplus in 2017-18.

Taken together, all the proposed actions and measures will accelerate Ontario’s plan to eliminate the deficit and reduce Provincial debt.

As measured by the accumulated deficit, the Provincial debt will be reduced by $3.5 billion by 2017-18.

Please click here for more info about the updated Ontario’s 2012 Budget.

Ontario, Canada: Newsroom

NEWS RELEASE

Strong Action To Reduce Deficit Further

April 25, 2012

McGuinty Government’s Proposed Changes to 2012 Budget Would Accelerate Plan to Balance the Budget

The Ontario government has updated its fiscal plan, showing further reductions to the Province’s deficit. If passed, all revenue from the tax on Ontario’s highest income earners would be used to eliminate the deficit even faster.

With these proposed changes, Ontario’s deficit is now projected to be lower than originally forecast in the 2012 Budget. The government is projecting a deficit of $15 billion in 2011-12, down from $15.3 billion. In 2017-18, the year in which the budget was initially forecast to balance, the government is now projecting a $0.5 billion surplus.

These proposed changes include no net new spending and, as a result, the province’s expense outlook remains unchanged from the 2012 Budget.

As a result of these actions, provincial debt, measured as the accumulated deficit, would be reduced by $3.5 billion by 2017-18.

QUOTES

“The single most important thing we can do to grow the economy is to eliminate the deficit. A stronger economy leads to better schools and health care. In the context of this minority government, we have been able to move our Budget forward with no new spending – and in fact, we would be eliminating the deficit even faster.”

– Dwight Duncan

Minister of Finance

QUICK FACTS

- The government’s March 27, 2012 Budget took strong action to eliminate the deficit while protecting the health and education services families rely on most. Balancing the budget is also essential for economic growth and job creation.

- Ontario’s deficit in 2011-12 is now projected to be $15 billion, an improvement of $0.3 billion compared to the projection outlined in the 2012 Budget. The 2011-12 actual results will be presented in the 2011-12 Public Accounts, released later this year.

LEARN MORE

CONTACT

- For public inquiries call

1-800-337-7222

TTY: 1-800-263-7776

Ministry of Finance

ontario.ca/finance

——————————————————–

You may also like: